This year only, American taxpayers can once again deduct charitable contributions on their 2020 tax returns.

Since 2018, when the Tax Cuts and Jobs Act (TCJA) went into effect, most taxpayers have not been able to deduct donations. The TCJA roughly doubled the standard deduction resulting in a significant drop in the number of taxpayers who can itemize deductions. Ninety percent of taxpayers are now unable to deduct their contributions to charity.

The Coronavirus Aid, Relief, and Economic Security (CARES) Act, passed by Congress in March, changed this. The CARES Act includes two temporary changes to the tax treatment of charitable donations.

1.Taxpayers who don’t itemize deductions on their tax returns can deduct $300 for cash donations made in 2020.

- This is in addition to the standard deduction which, for 2020, is $12,400 for single taxpayers and $24,800 for married couples filing jointly.

- Joint filers can deduct up to $600.

- Only non-profit 501(c)(3) public charities qualify. Websites such as Charity Navigator and Guide Star can help you identify qualifying organizations.

- Donations must be cash. Donations of clothing or household goods are not included.

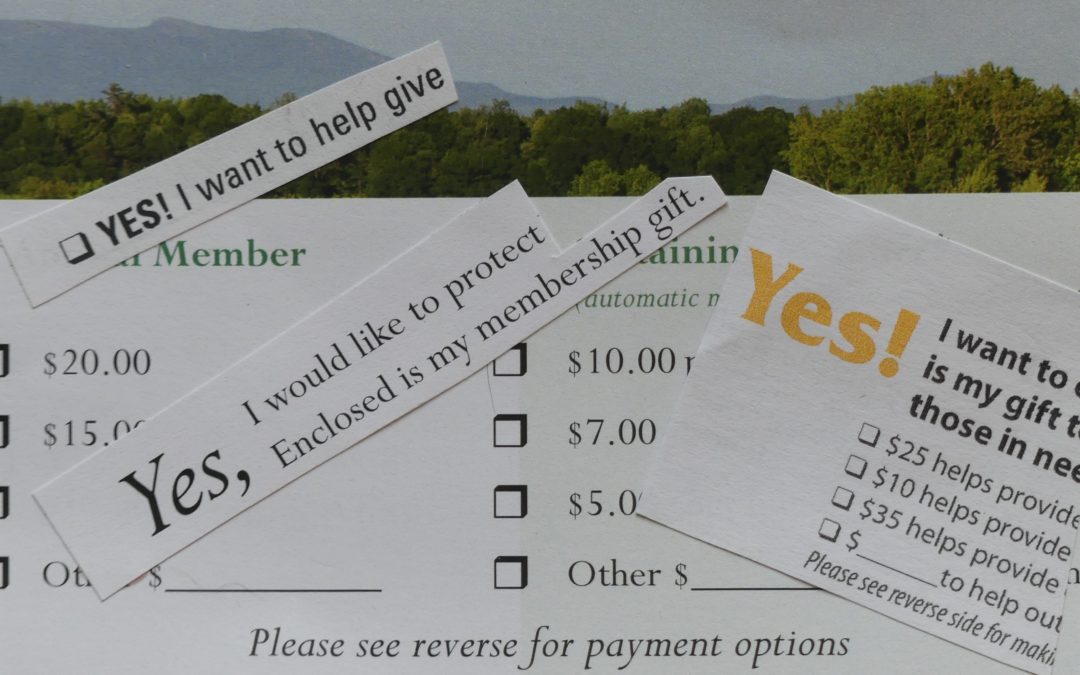

- Documentation is required. For contributions over $250, this must be a receipt from the charity. For donations less than $250, an image of a canceled check, a bank or credit card statement, or other documentation is acceptable.

- Gifts made to individuals directly and through websites such as GoFundMe do not qualify. (These are considered gifts, not donations.)

2.Taxpayers who can still itemize deductions on their tax returns can give up to 100% of their adjusted gross income (AGI).

- This is up from the regular limit of 60% of adjusted gross income.

- It is possible for itemizers to give the equivalent of their AGI. For example, if their AGI in 2020 was $200,000 and they donated that amount to qualifying organizations, they would have no taxable income.

- This deduction applies only to 501(C)(3) public charities and does not include 501(C)(3) private foundations or donor-advised funds.

Regardless of whether you itemize deductions on your tax return, all donations must be made in 2020.

When most American taxpayers could no longer deduct donations, charities were negatively impacted. The spread of the coronavirus which causes COVID-19 has placed more stress on non-profits. A $300 tax-deductible donation, while small, will help.

Most people don’t know about the $300 tax deduction. Help spread the word.

This blog is published to provide you with general information only and is not intended to provide specific or comprehensive advice. Money Care, LLC encourages individuals to seek advice from competent professionals when appropriate.